Real life use cases

Our fund, B&Z Trenttum, trades a portfolio of global assets, including equities, currencies, interest rates and commodities. As part of our promise to ensure risk is managed appropriately for each particular asset as well as the entire portfolio, we needed an internal data sharing solution that would help us collaborate more effectively, and share key price and analytics data in real time. Speed to market in combination with superb performance, high quality service and support requirements led us to choose MDX Technology from a pool of vendors, including Arcontech, Vistasource and others.

B&Z Trenttum

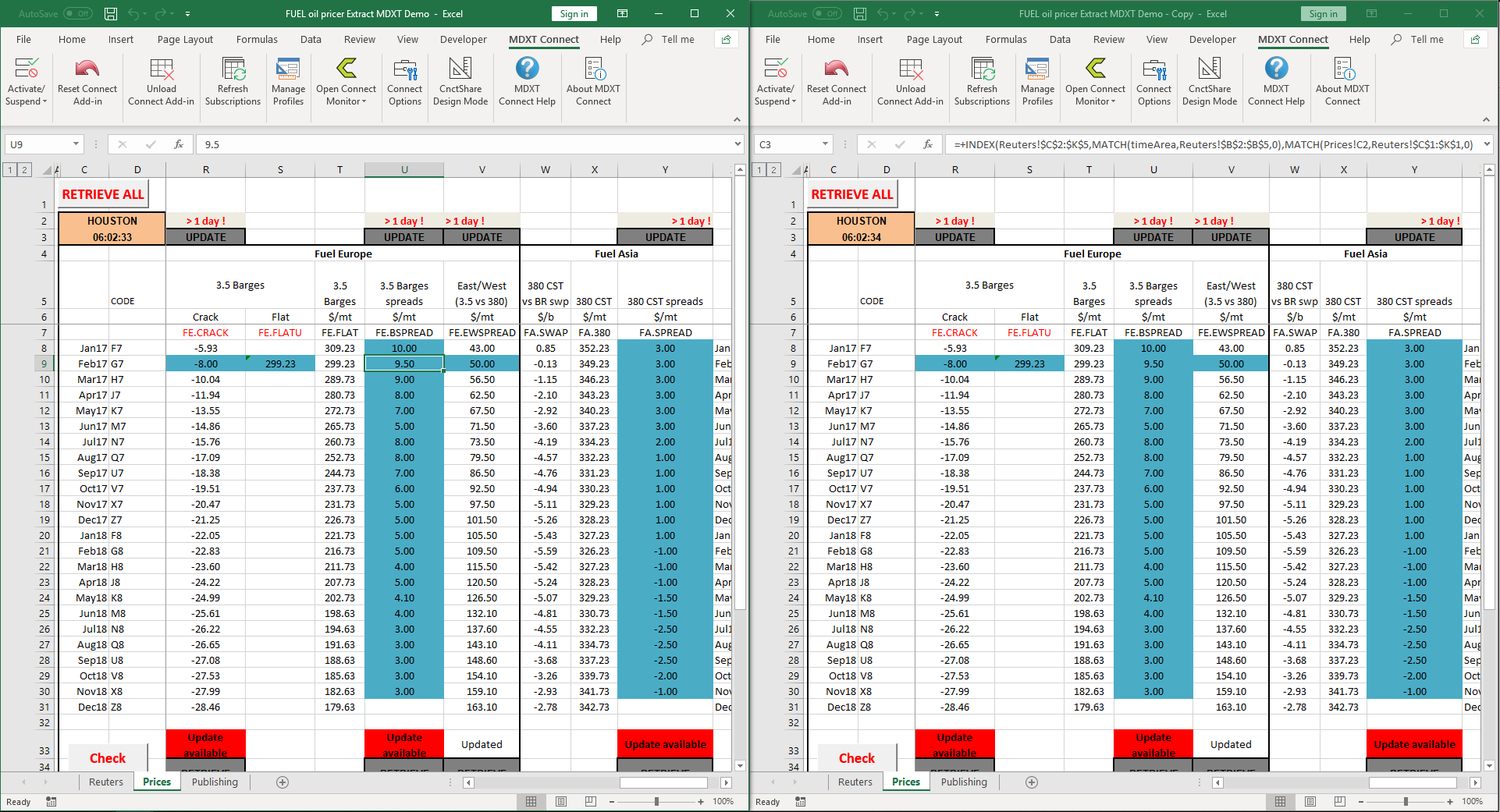

As a global business we are constantly looking for ways to improve trader collaboration which in turn will improve our overall customer service capabilities. The MDXT solution is helping us to achieve this key objective. The first phase of the implementation is being used by our traders who are based in Geneva, New York City and Singapore and can now all share the same picture of all potential transactions in real-time, before trade execution, irrespective of their geographical location. This is very important because we can now very quickly, and accurately, provide our clients with a variety of trading opportunities based on validated pricing information.

Global commodities firm

We were very impressed by the ease of implementation and integration of the MDX solution within our trading environment. Also the rich features of the real-time subscription, publication and sharing functions of the Excel add-in were very important to us in selecting MDX to replace an incumbent third-party technology. In the end, stability and performance especially during times of high market volatility were absolutely key.

Marco Tartaglini, Director, Portfinance

Clients using it:

- PORTFINANCE

- LITASCO

- B&Z GS

Request a Demo

Complete the form and someone from the team will be in touch shortly